This means that the average company takes about 8.5 months to collect payments from its customers.

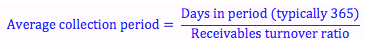

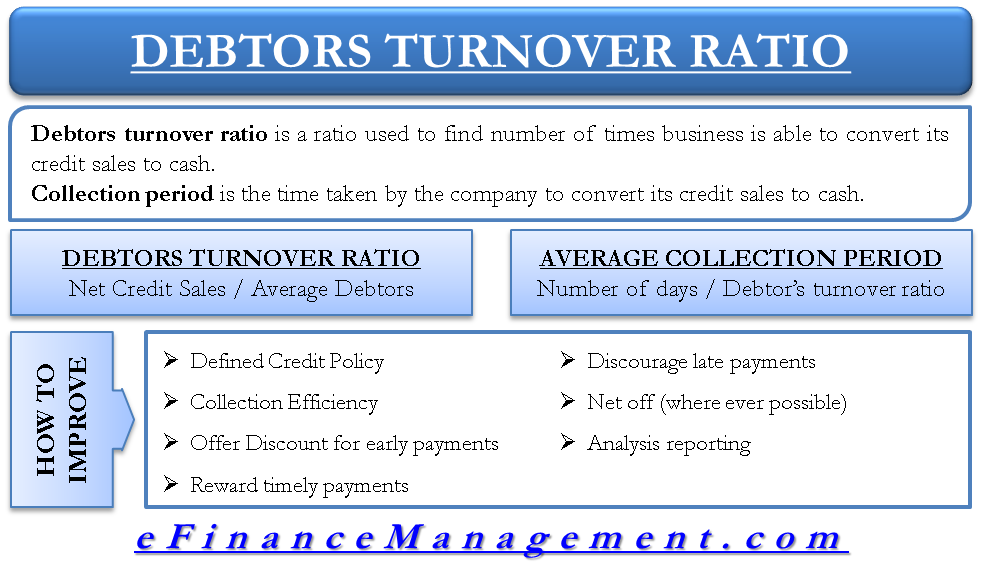

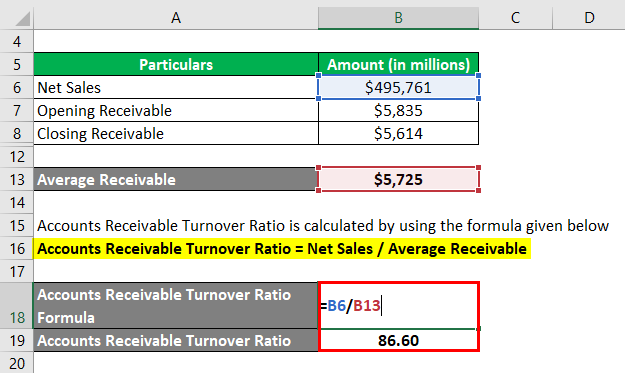

The average accounts receivable turnover for companies in the United States is about 8.5 times per year. What Are the Typical Ratios for Accounts Receivable Turnover? This is calculated by dividing the company's total net credit sales by its average accounts receivable balance, and then multiplying this by 365. Receivables turnover is a measure of how quickly a company collects its receivables. This is calculated by dividing the company's total net credit sales by its average accounts receivable balance. What's the Difference Between Accounts Receivable Turnover and Receivables Turnover?Īccounts receivable turnover is the number of times per year that a company's average accounts receivable balance is turned over. This ratio can be used to measure a company's effectiveness in collecting payments from its customers. The ratio is calculated by dividing the company's total annual sales by the company's average accounts receivable balance. The accounts receivable turnover ratio is a measure of how quickly a company collects its accounts receivable. How Do You Calculate Accounts Receivable Turnover?

A high turnover rate indicates that the company is collecting payments quickly, while a low turnover rate suggests that it is taking longer to collect payments from customers. This metric is a measure of how quickly the company is able to turn its receivables into cash. It is calculated by dividing the company's annual net sales revenue by the average amount of accounts receivable outstanding during the year. Accounts receivable turnover is a measure of how efficiently a company is collecting payments from customers on outstanding invoices.

0 kommentar(er)

0 kommentar(er)